The Helium Network has a vision centered on creating a decentralized IoT hotspot network with a strong focus on privacy and security. In contrast, the recently launched Amazon Sidewalk network shares a similar goal but takes a different stance on privacy. This dynamic presents a familiar fable: who plays the role of the swift hare, and who embodies the steady tortoise? Could Amazon be the quick starter with its network, while Helium steadily grows, poised to outperform Amazon? The answer may well hinge on the distinction between centralized and decentralized services.

Redefining Internet Infrastructure

Traditional internet infrastructure relies on a limited number of large ‘hotspots’ or ‘gateways.’ However, modern technology enables the system to function with a multitude of smaller gateways. The challenge in internet infrastructure lies in establishing gateways at a scale that rivals industry giants. Amir Haleem, Helium’s CEO, believes that, with the right financial incentives, people will voluntarily join the Helium Network as a decentralized alternative to IoT leaders. The Helium token serves as this incentive, attracting early adopters and driving network growth once its potential becomes evident. In 2013, Helium conducted its Initial Coin Offering and later introduced ‘The People’s Network,’ heralding a significant shift in networking infrastructure that piqued the interest of tech enthusiasts.

Emerging Opportunities and Big Tech Competition

As Helium’s opportunities expand, it naturally attracts the attention of major tech companies poised to either acquire or compete with it. Amazon, a dominant force in the market with products like Amazon Echo and Amazon Web Services (AWS), previously held sway. Despite growing concerns about Amazon’s approach to privacy, its omnipresent microphone remained inconspicuous, overshadowing any opposition.

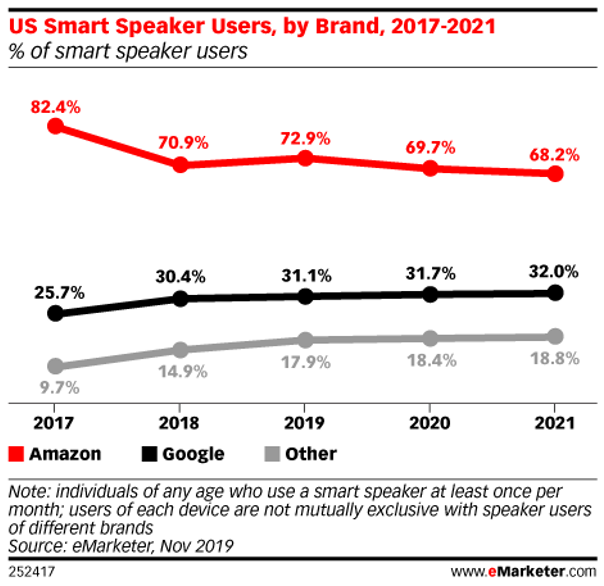

Amazon’s Dominance in a Maturing Market

In the chart above, we can see Amazon maintaining a strong majority in the market even as it matures, with no viable alternatives making significant inroads. According to TechCrunch, approximately 30% of internet users have adopted smart-home speakers, and year-over-year sales are showing slower growth. This slowdown is a concern for Amazon, leading them to consistently lower the price of the Echo Dot to spur adoption. Despite this, the fundamental utility of smart speakers for most users remains relatively unchanged.

Data Collection Over Innovation

Rather than focusing on expanding the functionality of their products, Amazon has turned its attention to gathering more user data. The market for user data is thriving, which may explain why Amazon and Google offer more affordable products compared to the privacy-centric Apple. In the case of Amazon Sidewalk, there is little motivation to enhance the security of consumer data. Amazon seems to rely on consumer unawareness, as seen in their quiet introduction of Sidewalk on June 8th, pushed to all compatible devices overnight. Additionally, users must individually opt-out, which further raises concerns about data privacy. If Sidewalk truly offered exceptional value, consumers would willingly opt-in. However, the evidence suggests that Amazon stands to gain significantly, while consumers risk compromising their privacy without substantial benefits.

Control and Data Privacy: Amazon vs. Helium

Amazon maintains full control of its network, whereas Helium places users in charge. Helium users have the liberty to use the network and benefit from it while having the assurance that their data remains peer-to-peer, shielded from the watchful eyes of big tech companies. Unlike Amazon, which leverages existing infrastructure from unsuspecting consumers, Helium’s approach revolves around cryptocurrencies and the quest for a reliable network. Amazon’s scale gives them a competitive edge, but Helium’s steady development of their model sets them apart.

User Placement and Efficiency: Amazon Echo vs. Helium

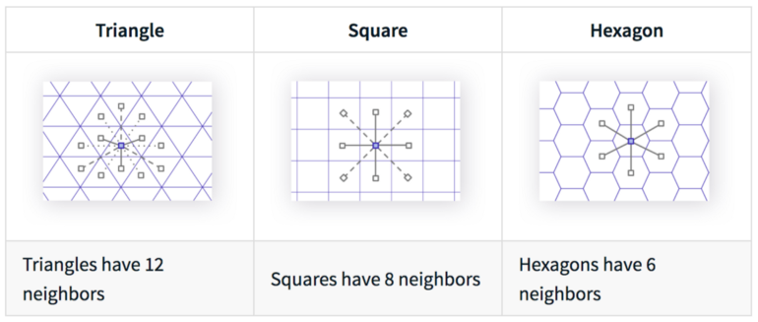

Amazon consumers typically position devices for convenience, whereas Helium users prioritize efficiency and range. Helium has designed a public reward system that safeguards the identity of gateway hosts, optimizing efficiency. Instead of using a conventional map coordinate system that reveals precise user locations, they employ an H3 grid known as the “Hexagonal Hierarchical Geospatial Indexing System,” a proven open-source technology. Hexagons, unlike squares and triangles, maintain uniform distances between neighboring hexagons, ensuring a fair and predictable reward system. With the H3 grid, users can confidently identify the optimal locations for gateway installation, secure in the knowledge that they will receive equitable rewards. Helium incentivizes users to strategically deploy gateways to expand the network’s reach effectively.

Source: https://uber.github.io/h3/#/documentation/overview/use-cases

Source: https://uber.github.io/h3/#/documentation/overview/use-cases

The figure indicates Hexagon’s advantage over other shapes for creating equal distances for nodes.

Source: https://blog.helium.com/mapping-the-world-with-hexagons-49f57d8b3df5

Source: https://blog.helium.com/mapping-the-world-with-hexagons-49f57d8b3df5

The map above illustrates the H3 grid in New York City, white dots represent gateways.

Gateways are low-powered computers with antennas that broadcast LongFi radio. Many hotspots are based on a Raspberry Pie, a popular computer for IoT devices with a budget friendly price of only $35. Originally users made their own hotspots but unfortunately, this ability was abused and disabled. The HIP19 system implements a simple process for 3rd party manufacturers to produce and sell pre-built hotspots. A system currently underway allows users to manufacture their own hotspots again, but it is a difficult process as the network could be negatively impacted by unsafe hotspots.

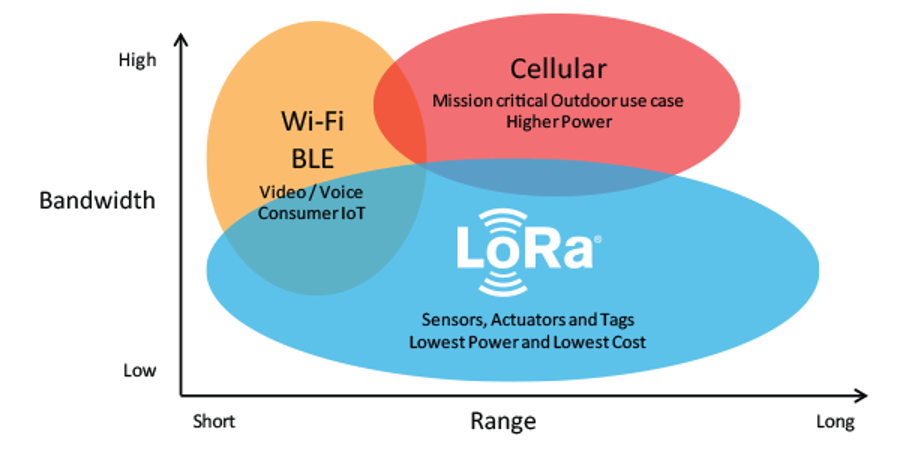

Hotspot antennas broadcast LoRaWAN (Long Range Wide Area Network) radio waves. LoRa radio technology released in 2009, the 2 founders (Nicolas Sornin and Olivier Seller) partnered with François Sforza, the three founded Cycleo. Their goal was to simplify electric and gas meter readings with low-cost IoT sensors. The team discovered how to send data utilizing Chirp Spread Spectrum (CSS) Modulation technology used for aviation radars, and similar to dolphin’s echolocation. In May 2015, Semtech acquired Cycleo, the 3 worked with Semtech to advance the LoRa chips for sensors and gateways. In February 2015 they finalized chip designs along with LoRaWAN protocol. The LoRa Alliance launched, its mission is to promote LoRa technology and expand its global impact. While LoRa does not plan to replace wifi or cellular, it fills in the voids between both technologies.

Figure illustrates the low bandwidth and wide interval of range of LoRa compared to Wi-Fi and Cellular.

Helium is undergoing an ambitious process to establish a network like the one Amazon Sidewalk aims to monitor. Both projects accurately resemble the centralized vs decentralized conflict facing the future of technology. Helium users are incentivized to create an efficient network, where the community can propose and approve protocol changes beneficial to everyone. Compared to Amazon, users are mainly concerned with convenience and price, but are at the mercy of how Amazon uses their data. Both realities side by side indicate that Amazon is indeed losing the fight against crypto. Amazon is only incentivized to improve Sidewalk in terms of data collection, whereas Helium users are paid to develop a network they strongly believe is the future of privacy and security on the internet.

Alexa voice hacks:

https://www.theguardian.com/technology/2018/may/24/amazon-alexa-recorded-conversation

Helium hexagon hotspot map:

https://blog.helium.com/mapping-the-world-with-hexagons-49f57d8b3df5

https://blog.helium.com/mapping-the-world-with-hexagons-49f57d8b3df5

By Matthew Jessup and Simon DeCapua

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at info@sarsonfunds.com

Source:

Source: