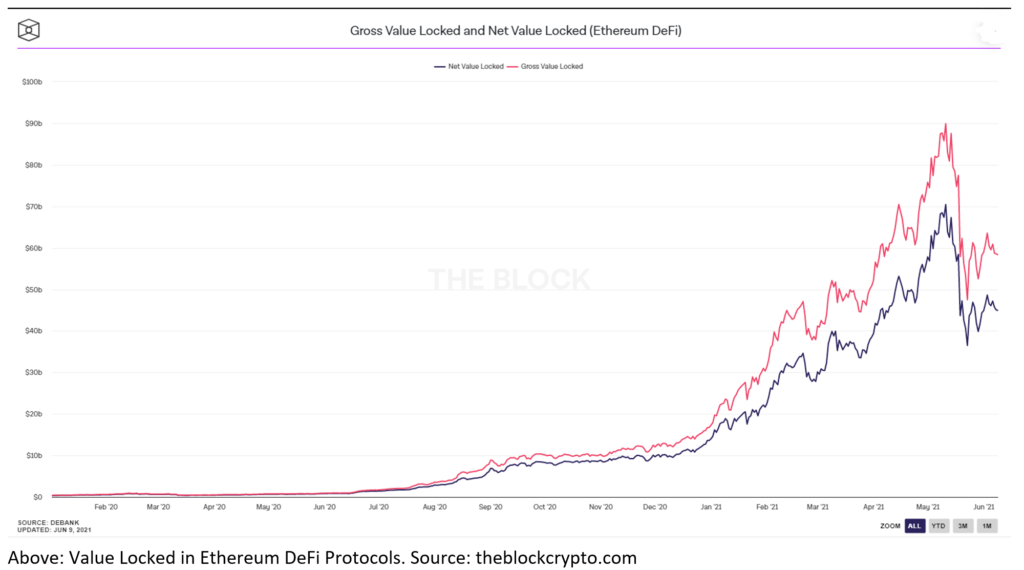

Ethereum is the leading Blockchain for decentralized applications (dApps) globally. With net value locked in Ethereum surpassing $50 billion in mid-April this year, the network’s growing list of decentralized finance (DeFi) protocols are beginning to rival formidable financial institutions. However, growing adoption is causing network congestion, making Ethereum too slow and cost prohibitive for certain applications and user bases. With Ethereum 2.0’s uncertain implementation timeline, many projects are vying for the title of “Ethereum killer”, if not the humbler “Ethereum scaling solution”. Among these solutions, Polygon is perhaps the most promising.

Polygon, previously Matic Network, takes a unique approach to scaling Ethereum by leveraging instead of fighting against the diverse ecosystem of existing scaling solutions. By providing “…a framework for building and connecting Ethereum-compatible blockchain networks”, Polygon creates value through fostering Ethereum network effect expansion. Accordingly, its valuations have skyrocketed in 2021.

The growing list of projects using Polygon architecture shows how embedded the network has already become in the DeFi ecosystem. Liquidity providers like Aave, exchanges like Curve, and prediction markets like Augur are examples of DeFi protocols whose combined efforts are automating and threatening to replace large segments of the legacy financial system. So long as Polygon continues to add value by aggregating Ethereum’s diverse set of scaling solutions, it will likely continue its rapid growth.

Because the subject is so technical, there is uncertainty among investors with regards to Polygon’s long-term prospects. Since Ethereum 2.0’s shard chains will upgrade Ethereum’s scalability, it is natural to wonder whether solutions like Polygon will still be needed. However, we believe that Polygon’s value proposition is complementary to Ethereum 2.0. Vitalik Buterin, who is the founder of Ethereum, shares his perspective on the long term concerns for Ethereum in an October 2020 post:

“It seems very plausible to me that when phase 2 finally comes, essentially no one will care about it. Everyone will have already adapted to a rollup-centric [a type of scaling solution] world whether we like it or not, and by that point it will be easier to continue down that path than to try to bring everyone back to the base chain for no clear benefit and a 20-100x reduction in scalability.”

In other words, the current ecosystem of Ethereum scaling solutions may be so robust that by the time Ethereum 2.0 is fully implemented it would be counterproductive, or economically irrational, for network participants to bring all activity back to the base chain. Vitalik furthers his point, writing, “This implies a ‘phase 1.5 and done’ approach to eth2, where the base layer retrenches and focuses on doing a few things well – namely, consensus and data availability.”

We look forward to monitoring the ongoing development of the Ethereum ecosystem. As DeFi protocols continue to scale in breadth of applications and depth of user adoption, it is likely that many more blockchain scaling and bridging projects will be integrated. By offering an adaptive framework for combining these projects’ strengths, we are confident Polygon will continue to add value to the crypto asset space for the foreseeable future.

By Nathan Frankovitz

Disclosures: Not investment advice. It should be assumed that Sarson Funds or its affiliated managers hold positions in all projects that are discussed. It is not possible to invest in any project directly through Sarson Funds, Inc. or its affiliated managers. Any investment product offered by managers affiliated with Sarson Funds should be assumed to be only available to Accredited Investors and subject to the individual terms and conditions of that offering including but not limited to those eligibility requirements associated with U.S. Securities Regulation D, section 506c. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at info@sarsonfunds.com