MEET DISCRETIONARY STANDARDS

PUBLIC GOODS

SCALING & INTEROPERABILITY

ENVIRONMENTALLY SUSTAINABLE CONSENSUS MODELS

SOCIAL IMPACT

FINANCIAL INCLUSION

What Is ESG?

Cryptocurrency and blockchain technology have the potential to revolutionize the global financial system and provide greater financial inclusion to all. ESG (Environmental, Social, and Governance) is an important part of this revolution. ESG provides a framework for companies to ensure that their operations and investments are socially responsible, and environmentally sustainable. ESG–focused crypto projects promote energy efficiency and renewable energy sources, reducing the environmental impact of digital currency. They also focus on social and governance issues, such as the use of smart contracts to ensure fairness and transparency in transactions. ESG is essential to the growth and adoption of cryptocurrencies, and helps to ensure that the industry is held to the highest standards of environmental and social responsibility.

Environmental, social, and governance (ESG) criteria are a set of standards for a cryptocurrency that socially conscious investors use to screen potential investments. Environmental criteria consider the environmental sustainability and carbon footprint of a protocol’s consensus model. Social criteria examine how a cryptocurrency demonstrates potential positive effects for people and communities. Governance deals with a cryptocurrency’s ability to expand the reach of capital markets through decentralized and permissionless delivery of financial goods and services.

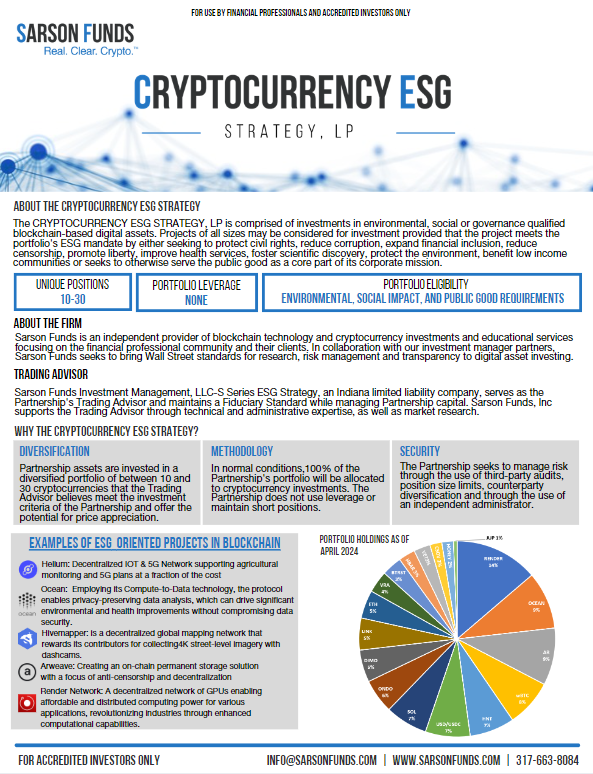

The CRYPTOCURRENCY ESG STRATEGY, LP is comprised of investments in cryptocurrencies that meet certain discretionary standards under one or more of the following categories: Public Goods, Scaling and Interoperability, Environmentally Sustainable Consensus Models, Social Impact, and Financial Inclusion.

Learn about Crypto and ESG

Book an Info Session

Book a digital asset discovery session to learn more about this strategy, or other strategies offered by Sarson Funds.

At a Glance

Strategy Overview

Investment Process

Public Goods

Public goods are non-excludable, non-rivalrous utilities and services that provide benefit to the public.

Scaling and Interoperability

This includes protocols implemented to improve the feature set of high-traffic Layer 1 networks, enabling fee reduction, energy cost/tax reduction, or higher throughput computing environments.

Environmentally Sustainable Consensus Models

These are networks that leverage Proof-of-stake models, or similarly energy efficient consensus models. In cases of Proof-of-work consensus, constituents will only be included on the basis of provably sustainable energy sources.

Social Impact

These constituents demonstrate a disintermediation of centralized bodies, which drive current or potential positive effects for people and communities.

Financial Inclusion

These protocols seek to expand the reach of modern capital markets through permissionless and decentralized delivery of financial goods and services.

90 Day Lockup & Low Minimums

Rather than a multi-year lockup, ours is only 90 days. Deposits are accepted daily with a minimum investment of $50,000 USD.

Dedicated Client Portal & Daily NAV

Investors receive a dedicated client log-in portal, for up-to-date account performance, net asset value (NAV), and document management.

Request Information

Submit this request form to receive investor information.

View other investment strategies

Cryptocurrency ESG

MEET DISCRETIONARY STANDARDS PUBLIC GOODS SCALING & INTEROPERABILITY ENVIRONMENTALLY SUSTAINABLE CONSENSUS MODELS SOCIAL IMPACT FINANCIAL INCLUSION What Is ESG? Cryptocurrency

SmartCrypto 15 Index: Crypto Investment Strategy

RULES-BASED INVESTMENT PROCESS DIVERSIFY PARTNERSHIP CAPITAL 15 LARGEST ELIGIBLE CRYPTOCURRENCIES By the Numbers The SMARTCRYPTO 15 INDEX, LP uses a

Crypto Income Strategy Fund

US-Listed Cryptocurrencies 15% Target Annual Yield $50k Minimum Investment crypto & income strategy awards #1 Top Performing Crypto Fund, Long-Only

Large Coin Fund | Blockchain Momentum LP

Top 10 Cryptocurrencies $1bn Market Cap Eligibility $50k Minimum Investment Large Coin Strategy awards This fund was ranked based on

Small Coin Fund | Fifth Khagan LP

40 to 60 Small Cap Crypto Holdings team managed United States Domiciled No leverage 5+ Year Track Record Monthly Liquidity